Market Report: Weak policies equal higher gold prices

Sep 23, 2016·Alasdair Macleod

This week, both the Bank of Japan and the Fed announced their interest rate policies.

The BoJ came up with an underpinning of 10-year JGBs at zero yield, and the Fed came up with, well - nothing. Except, the FOMC reckoned long-term real GDP growth was likely to be about two per cent, rather than previous hoped-for rates of three or four per cent.

That bit of the FOMC statement didn’t get much publicity, but it represents the Fed throwing in the towel on monetary policy. Japan has no more significant policy tweaks either. So what we are seeing is an admission that interest rates will have to be kept at zero and negative respectively for a prolonged period of time, because neither central bank really knows what else it can do.

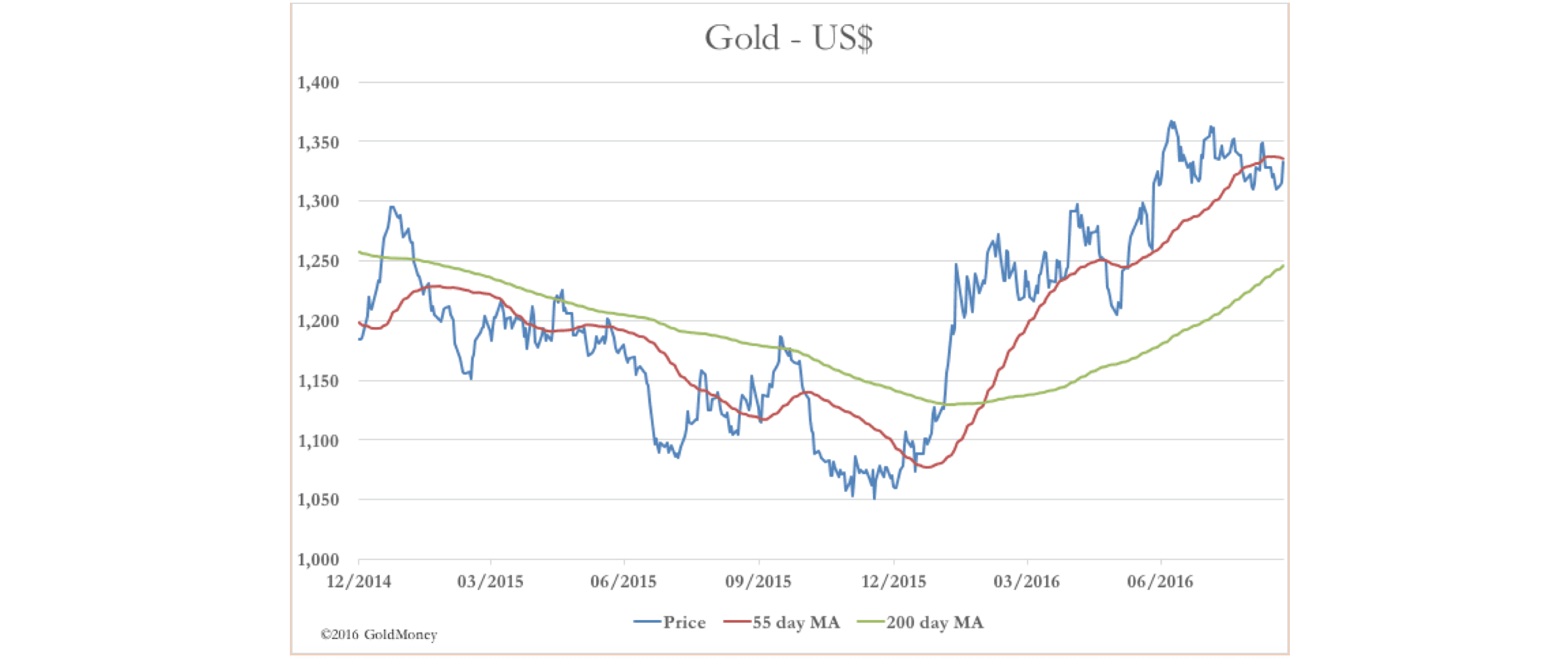

Gold and silver had begun to rally ahead of the interest rate announcements, and following the Fed’s on Wednesday night, gold jumped 2%, and silver by 4%. Silver in particular has had a good week, with the dollar price rising from a low of $18.78 to a high yesterday (Thursday) of $20.07, up nearly 7%. This morning it had eased to $19.80 in early European trade. Gold rose from a Monday low of $1309.5 to a high of $1343.7 yesterday, a rise of 2.6%. This morning it opened at $1335, after some profit-taking. Taking into account the confirmations of continuing weak interest rate policies, there is a good chance that we can say support above $1300 for gold has held, and it is now ready for a challenge of this year’s high at $1370. If gold can clear the $1345-50 level, this outlook will be confirmed. The technical position is shown in our next chart.

Ahead of the FOMC meeting, analysts commentary was mixed, with a number of them recommending profit-taking in gold. This reflected the reasonable possibility that support at the $1300 level would not hold, and a move towards $1250, where the 200-day moving average currently resides, was on the cards.

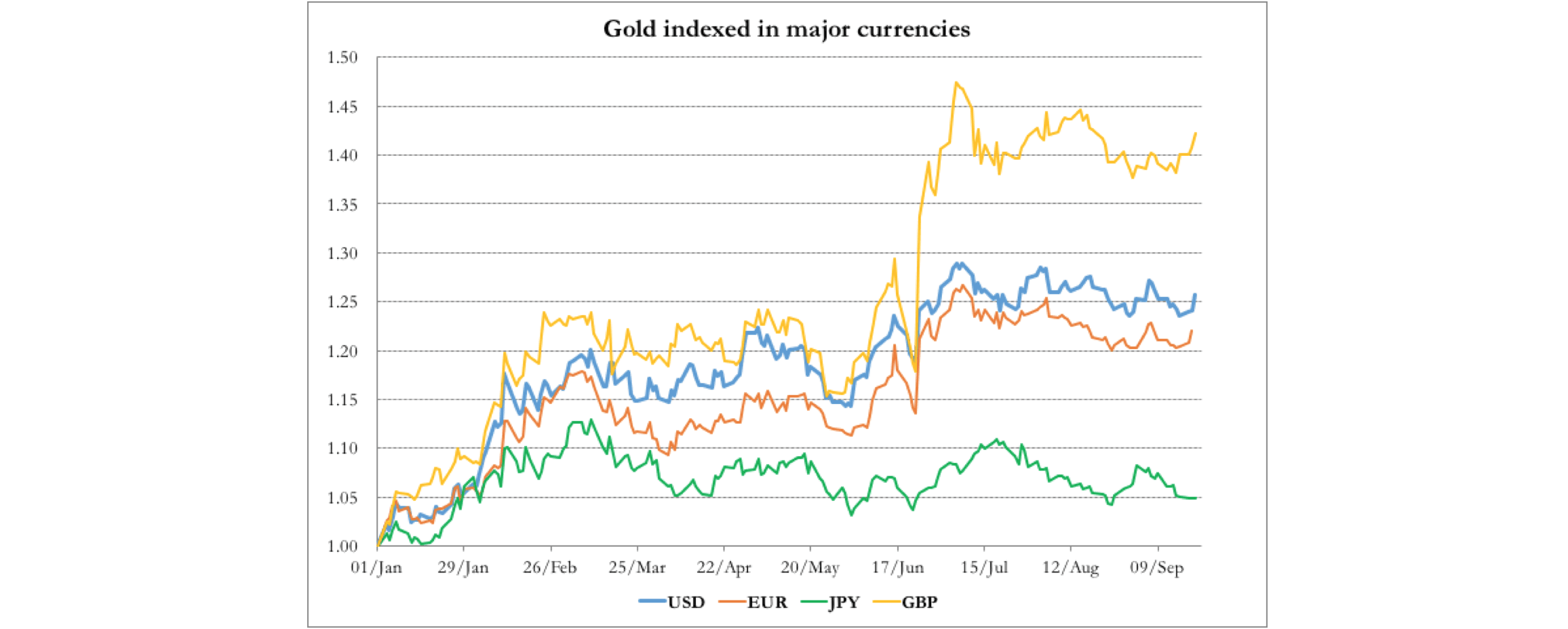

This year’s gold performance in other currencies is worth a look, which is our next chart.

The differences reflect currency movements as well as gold itself, and there are two things worthy of comment. First, the euro has weakened over the long-term, and if it breaks below $1.10 that could signal a move to challenge parity (it is currently 1.1216). The event that might cause this is deterioration in Italy’s economy, or renewed banking concerns. Secondly, the Japanese yen is poised at the JPY 100 level to the dollar (currently 100.720), which if broken could signal a bout of further strength for the yen. While we will only know these outcomes in retrospect, it is therefore worth allowing for a degree of currency volatility when considering future precious metal prices. Finally, silver’s outperformance is worthy of a special mention. This week, it has been noticeable how silver’s intraday movements have tended to lead the gold price. The most likely explanation is that there is a degree of front-running by insiders, sensitive to the larger flows taking place in gold. At the same time, its outperformance during the week suggests a shortage in physical and paper markets, which the bullion houses are reluctant to supply by the creation of yet more contracts.

The views and opinions expressed in this article are those of the author(s) and do not reflect those of Goldmoney, unless expressly stated. The article is for general information purposes only and does not constitute either Goldmoney or the author(s) providing you with legal, financial, tax, investment, or accounting advice. You should not act or rely on any information contained in the article without first seeking independent professional advice. Care has been taken to ensure that the information in the article is reliable; however, Goldmoney does not represent that it is accurate, complete, up-to-date and/or to be taken as an indication of future results and it should not be relied upon as such. Goldmoney will not be held responsible for any claim, loss, damage, or inconvenience caused as a result of any information or opinion contained in this article and any action taken as a result of the opinions and information contained in this article is at your own risk.