Dealing Desk: Gold emerges as the anchor in uncertain waters

May 21, 2015·Kelly-Ann KearseyIt has been a good week for gold on the worldwide markets, although GoldMoney customers have been indulging in a spot of speculation and profit taking.

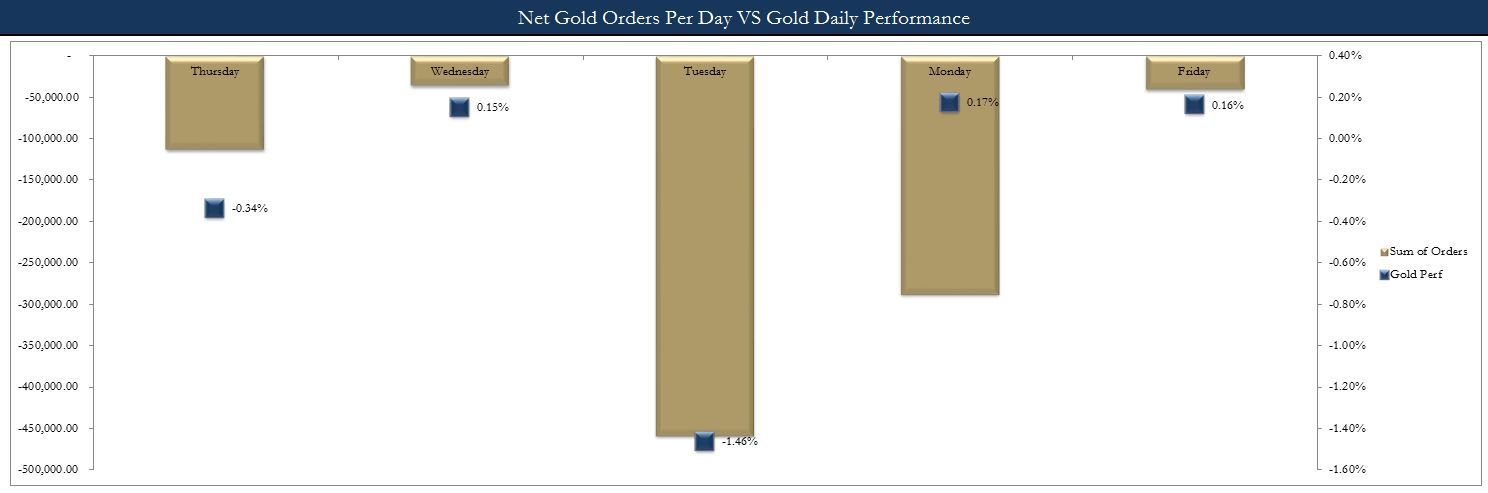

Kelly-Ann Kearsey, Dealing Manager at online precious metals dealer, GoldMoney says it has been an interesting week for customer behaviour, 'The Federal Open Market Committee (FOMC) minutes on Wednesday took a more doveish stance which supported the gold price at the expense of the dollar, but what is interesting is that we noticed our customers buying gold on the Tuesday, before selling after the FOMC announcement. This looks like it could be a bit of speculation and profit taking.'

The dollar has today, Thursday, made some advances which have weighed negatively on the gold price, but the yellow metal remains above the $1200 psychological level.

'Most of our selling has been out of the UK and Switzerland, as usual,' says Kelly-Ann, 'with Hong Kong and Singapore vaults the focus of buying. The gold/silver ratio is still high in the 70s, and the scarcer platinum remains below its yellow cousin in price.

What next?

Gold has slipped slightly today, but it is certainly not looking sickly. The recent World Gold Council report showed gold demand slipped modestly at the start of this year and shows that despite a bullish dollar, the precious metal has not lost its sheen. While prices are not rising dramatically, they are at a three month high and the market looks to be well supported. With increasing concerns about the strength of the US and Chinese economies, and the threat of another recession appearing on the horizon, gold support is likely to stay firm.'

Week on week price performances

21/05/15 16:00: Gold down 1.3% to $1,205.71, Silver down 1.3% to $17.15, Platinum down 0.9% to $1,146.60 and Palladium down 0.4% to $773.85.

Ends

NOTES TO EDITOR

For more information, and to arrange interviews, please call Gwyn Garfield-Bennett on 01534 715411, or email [email protected]

GoldMoney

GoldMoney is one of the world's leading providers of physical gold, silver, platinum and palladium for private and corporate customers, allowing users to buy precious metals online. The easy to use website makes investing in gold and other precious metals accessible 24/7.

Through GoldMoney's non-bank vault operators, physical precious metals can be stored worldwide, outside of the banking system in the UK, Switzerland, Hong Kong, Singapore and Canada. GoldMoney partners with Brink's, Loomis International (formerly Via Mat), Malca-Amit, G4S and Rhenus Logistics. Storage fees are highly competitive and there is also the option of having metal delivered.

GoldMoney currently has over 20,000 customers worldwide and holds over $1billion of precious metals in its partner vaults.

GoldMoney is regulated by the Jersey Financial Services Commission and complies with Jersey's anti-money laundering laws and regulations. GoldMoney has established industry-leading governance policies and procedures to protect customers' assets with independent audit reporting every 3 months by two leading audit firms.

Further information:

Visit: Goldmoney.com or view our video online